Professional Tax Preparation Services in Las Vegas

At CPA Attorney, we offer expert tax preparation services in Las Vegas, Nevada. As a dual-qualified CPA and attorney, we provide precise and tailored solutions for individuals and businesses. Trust us to handle your tax needs, so you can focus on what matters most.

What is Tax Preparation, and Why Does It Matter?

Tax preparation is the process of gathering financial documents and filing accurate tax returns with the IRS and state authorities. Whether you’re an individual or a business, proper tax preparation helps minimize errors, reduce audit risks, and ensure you don’t overpay taxes. Working with a qualified professional can also uncover deductions and credits you might miss on your own.

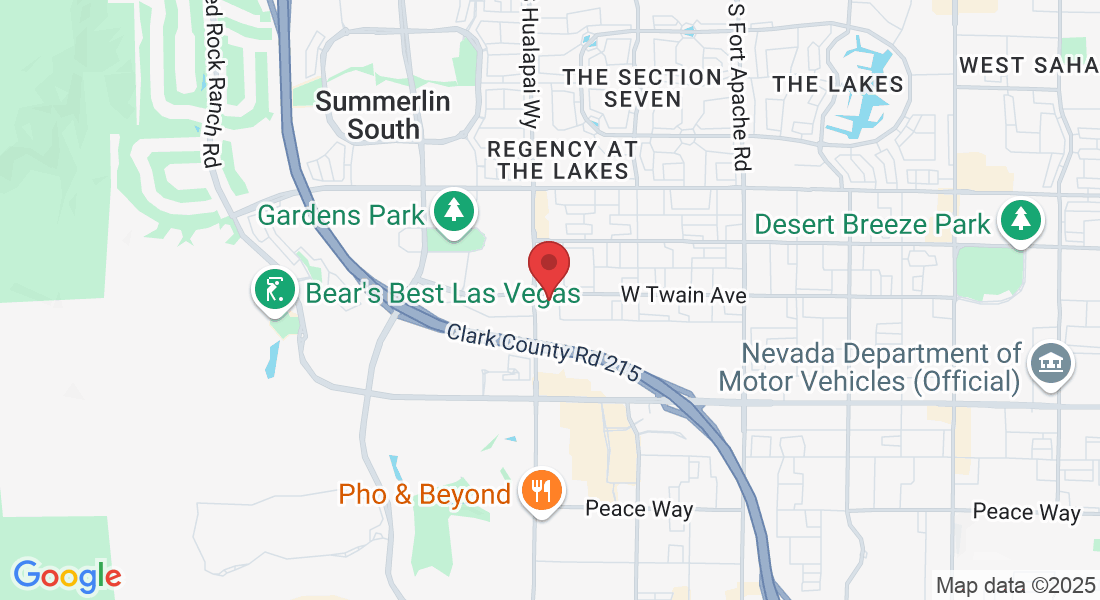

Tax Preparation in Las Vegas, Nevada

Trusted CPA and Attorney-Led Tax Filing Services

If you're looking for reliable, professional tax preparation in Las Vegas, CPA Attorney is your go-to resource. As a law firm led by a licensed

CPA and Attorney, we provide precise, compliant, and strategic tax filing services to individuals, businesses, trusts, estates, and nonprofits.

We’re more than tax preparers—we’re trusted advisors who ensure that every form is accurate and every opportunity to reduce liability is explored. Whether it’s your first time filing or your financial situation has grown more complex, we’re here to simplify the process and maximize your return.

Our Las Vegas Tax Preparation Services

We serve a wide range of clients, each with unique tax needs. Our comprehensive tax prep services include

Individual Tax Returns (Form 1040)

Whether you’re a salaried employee, a freelancer, or someone with multiple income streams, we prepare and file your Form 1040 with care and compliance. Our Las Vegas-based tax experts help you:

- Maximize deductions (e.g., home office, education, dependents)

- Claim eligible credits (e.g., Child Tax Credit, EITC)

- Navigate stock sales, crypto, or side gig income

- Avoid common mistakes that lead to IRS notices

Looking for personal tax preparation near Las Vegas? We’ll handle it from start to finish.

Business Tax Preparation (1120, 1120S, 1065, Schedule C)

Whether you run a corporation, partnership, or small business, our firm prepares:

- Form 1120 – C Corporation

- Form 1120S – S Corporation

- Form 1065 – Partnerships

- Schedule C – Sole Proprietorships and Single-Member LLCs

We go beyond simple filing—we identify potential deductions, structure your income correctly, and ensure every expense is accurately reported. For Las Vegas business owners, we’re your tax strategy and filing partner.

Trusts and Estates (Form 1041, Form 706)

Estate and trust tax returns are complex and highly sensitive to timing. Our firm handles:

- Form 1041 – Income tax return for estates and trusts

- Form 706 – Estate tax return for large estates

We help executors, trustees, and estate administrators file returns efficiently, minimizing tax liabilities and ensuring all legal and fiduciary duties are fulfilled. As both attorneys and CPAs, we bring an unmatched level of trust and precision to these filings.

Gift Tax Returns (Form 709)

If you’ve made large gifts or are engaged in wealth transfer planning, you may need to file Form 709. Our firm helps you:

- Determine whether a gift return is required

- Understand the lifetime gift and estate tax limits

- Properly file your annual gift tax return

Tax-Exempt / Nonprofit Organizations (Form 990)

We assist Las Vegas-based 501(c)(3) organizations and private foundations with:

- Annual Form 990 preparation and filing

- IRS compliance for donations and unrelated business income

- Advising on governance and reporting obligations

Even tax-exempt entities need professional guidance. Let us take care of the numbers so you can focus on your mission.

Trust

Why Choose CPA Attorney for Tax Prep in Las Vegas?

Our expertise in tax preparation ensures your returns are accurate, compliant, and optimized. We guide you through every step, providing clarity and confidence in your financial decisions.

CPA + Attorney Advantage

Most tax firms are either accounting-based or law-based. We’re both. Our dual-license structure gives you the legal and tax expertise needed to file correctly and avoid costly mistakes.

Local Knowledge

We’re based in Las Vegas, Nevada and understand both federal and Nevada-specific tax concerns. If you live or do business in Southern Nevada, we know the unique tax strategies that apply to you.

Security & Accuracy

Tax filing involves your most sensitive information. We use encrypted portals, strict confidentiality policies, and professional-grade tax software to keep your data secure.

IRS Representation & Audit Support

If the IRS comes knocking, we don’t pass you off—we stand with you. We offer audit support, IRS correspondence help, and legal representation.

best cpa and attorney in las vegas, nevada

Get Started with Tax Preparation in Las Vegas

If you’re searching for a Las Vegas tax preparer you can trust, CPA Attorney is here to help. We serve individuals, families, and business owners throughout Nevada with professional, attorney-backed tax services.

Proudly serving Las Vegas, Henderson, Summerlin, and surrounding Nevada areas

Related Services Available

At CPA Attorney, we specialize in guiding both business owners and individuals towards financial success through meticulous tax and financial planning. Our experienced CPA lawyers provide personalized solutions to ensure your financial stability both now and in the future.

Set up the appropriate legal framework for your company in order to optimize tax advantages and safeguard your possessions.

Make sure that your real estate deals and investments are in line with your financial objectives.

© Copyright 2025 – CPA Attorney