Federal Solar Tax Credit: Maximize Your Solar Investment Tax Benefits

Are you looking to maximize your savings on solar energy investments? Our comprehensive Solar Tax Plan is designed to help you unlock significant tax incentives, reduce energy costs, and contribute to a sustainable future. Whether you're a homeowner or a business owner, understanding and leveraging solar tax credits can significantly enhance your investment in renewable energy.

Benefits of Our Solar Tax Plan

Our Solar Tax Plan offers more than just the standard 30% Investment Tax Credit (ITC). With our expertise, you could potentially recover 40%, 50%, 60%, or even 70% of your solar investment through additional tax benefits. Our team of experienced CPAs, attorneys, and financial advisors will guide you through the process, ensuring compliance and maximizing your savings.

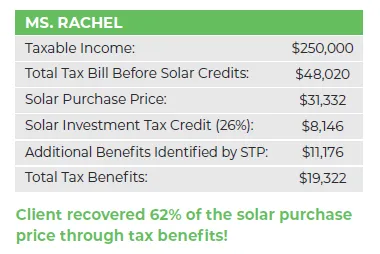

Real Solar Tax Credit Client Example

Taxable Income: $250,000

Total Tax Bill Before Solar Tax Planning: $48,020

Solar Purchase Price: $31,332

Solar ITC Tax Credit: $8,146

ADDITIONAL TAX INCENTIVES: $11,176

Total Tax Benefits: $19,322

62% Recovered In First Year!

See What You Can Save!

Are you considering solar or are a sales representative?

Check out our Solar Tax Credit Benefits Brochure.

FAQs

Frequently Asked Questions

What is the current Investment Tax Credit Rate?

The Inflation Reduction Act has set the Investment Tax Credit for homeowners and businesses at 30% through the year 2032.

What if I file my own taxes?

No need to worry. As a resource to you, we will provide a walk-through video to help you insert your solar tax forms into Turbo Tax or other self-serve tax Software.

Do I have to use your firm to file our taxes?

We encourage you to continue working with your current tax professional and will help answer their questions as needed. In some cases, a tax professional is not familiar enough with the taxation of energy credits. If that is the case, our Attorneys and CPAs can help file your taxes with the necessary solar tax documents.

What does it mean the Investment Tax Credit is Nonrefundable?

A nonrefundable tax credit can only be used to decrease or eliminate a tax liability. A taxpayer will not receive a tax refund for any amount that exceeds the taxpayer’s tax liability for the year.

My income is not very high. Does that mean solar is not for me?

For many, there are funds tied up in retirement accounts that will be taxable when pulled out. We will help you determine the most advantageous way to access this money without putting you in a bind for tax purposes.

What if I cannot claim the full 30% tax credit since my income is not high enough to claim the full credit?

Any unused tax credit will be carried forward year after year until it is all used up.

What is required to claim the Investment Tax Credit?

Section 25D allows the credit for property considered a dwelling and used as a residence including second homes and vacation homes.

Will I get the Investment Tax Credit if I purchase Solar for my Rental Property or Business?

Yes, the 30% tax credit can be claimed for a rental property or business. Whether you receive the full amount of the credit depends on the circumstances.

Highlights

30% Solar ITC Credit

Additional Tax Incentives up to 40%

Make sense of the Solar Investment

Solar Tax Form Preparation

A CPA, Attorney, and Financial Advisor on Your Team

Asset Protection and Estate Planning

Our Process

Enjoy peace of mind with our compliance assurance and protection against IRS audits.

Let us simplify solar tax planning and secure your financial future.

Consultation

We begin with a detailed analysis of your solar purchase decision.

Tax Form Preparation

Our experts prepare all necessary tax forms and provide guidance to your CPA.

Ongoing Support

We offer continuous support, including protection in case of IRS audits, ensuring you receive all entitled benefits.

Have questions? Need help? Contact us

Feel free to reach out during our business hours for assistance with estate planning, tax law, financial services, or other legal matters.

Call Us:

Visit Our Office:

10155 W. Twain Ave Ste 100 Las Vegas, NV 89147

Business Hours:

Monday - Friday: 8:00 AM - 5:00 PM

© Copyright 2025 – CPA Attorney