Guiding Your Financial Journey

Professional Insights on Estate, Tax, and Financial Planning

Top 10 Tax Deductions for Small Law Firms

Charge season can be challenging for little law firms, but understanding the accessible conclusions can assist you maximize your reserve funds. Here's a direct to the best 10 charge findings that can advantage your firm:

1. Office Lease and Utilities

Leasing office space and paying for utilities are noteworthy costs for small law firms. Both of these costs are completely deductible. Guarantee you keep nitty gritty records of your lease installments and utility bills to back your conclusions.

2. Proficient Expenses

Expenses paid to exterior experts, counting bookkeepers, specialists, and lawful specialists, are deductible. These costs are vital for keeping up your firm's operations and guaranteeing compliance with legitimate and administrative prerequisites.

3. Representative Pay rates and Benefits

Compensations, compensation, and benefits such as your employees' well-being protections and retirement arrange commitments are deductible. This moreover incorporates rewards and other shapes of stipend.

4. Office Supplies and Gear

Costs related to office supplies such as paper, pens, and printer ink are deductible. Also, costs for office hardware like computers, printers, and furniture can be deducted or deteriorated over time.

5. Lawful Inquire about and Instruction

Expenses for lawful inquiries about databases, memberships, and proceeding legitimate instruction (CLE) courses are deductible. These costs are basic for keeping your lawful knowledge up-to-date and significant.

6. Promoting and Publicizing

Costs related to showcasing and promoting your law firm, counting site improvement, social media advancements, and print advertisements, are deductible. Contributing in promoting makes a difference pulling in unused clients and developing your hone.

7. Travel and Suppers

Travel costs for business-related trips, counting transportation, lodging, and suppers, can be deducted. Guarantee that these costs are well-documented and specifically related to your trade exercises.

8. Legitimate Misbehavior Protections

Premiums paid for legitimate misbehavior protections are completely deductible. These protections secure your firm against claims of proficient carelessness and maybe a fundamental cost for running a law home.

9. Client-Related Costs

Costs caused by engaging clients or conducting trade gatherings, such as dinners and occasion tickets, can be in part deductible. Keep precise records of these costs and their commerce reason.

10. Deterioration of Resources

Expansive resources, such as office furniture and computers, can be devalued over time. Deterioration permits you to deduct the toll of these resources incrementally instead of all at once.

Conclusion

Maximizing your tax deductions can significantly impact your law firm’s bottom line. By understanding and utilizing these deductions, you can ensure that you’re taking full advantage of the tax benefits available to your practice. Always consult with a tax professional to ensure compliance and optimize your tax strategy.

Need Help With Your Law Firm’s Taxes?

If you need assistance navigating tax deductions for your law firm or have any other legal or financial questions, feel free to reach out. We're here to help you maximize savings and grow your practice.

Contact us today:

Phone: 702-852-2577

Email: [email protected]

Let us handle your tax and legal needs so you can focus on what matters most—your clients.

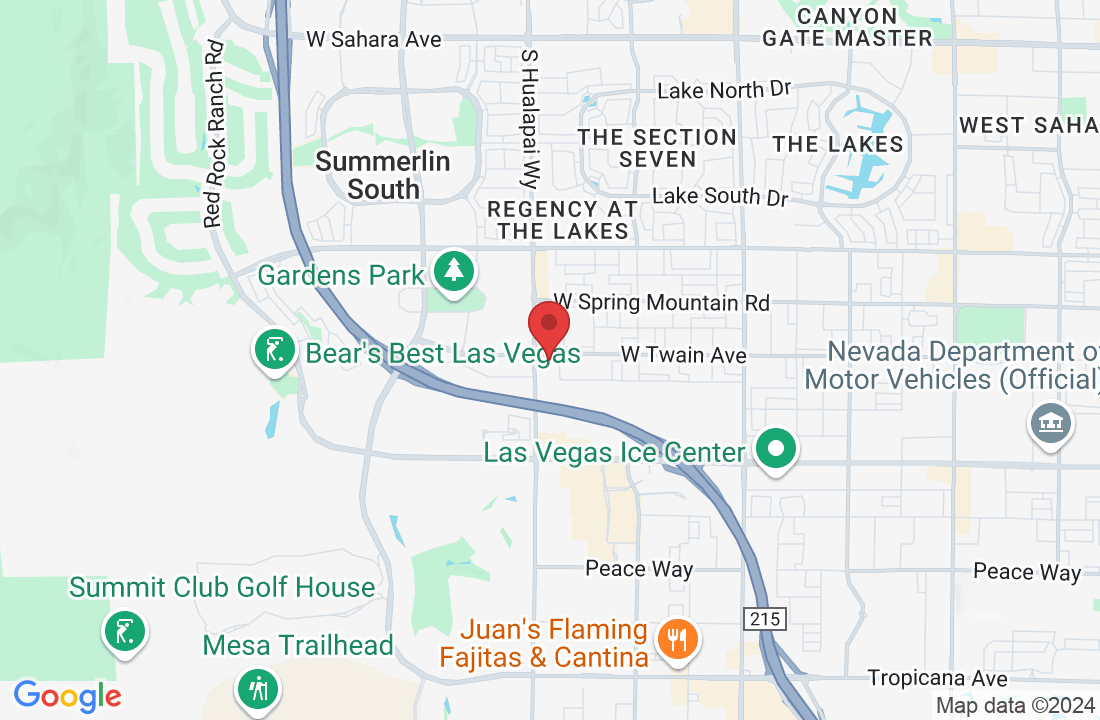

Welcome to the CPA Attorney Blog, where we blend expertise with a personal touch to help you navigate the intricate world of estate, tax, and financial planning. Nestled in the heart of Las Vegas, Nevada, our law firm is dedicated to empowering individuals and families to secure their financial futures with clarity and confidence. We understand that planning for the future can be daunting, which is why our seasoned attorneys are committed to providing you with personalized guidance every step of the way.

Our blog is your go-to resource for the latest updates, practical tips, and comprehensive analyses. Whether you're delving into the nuances of estate planning, exploring strategies to reduce tax burdens, or seeking ways to enhance your financial portfolio, we've got you covered. We aim to demystify complex legal and financial concepts, making them accessible and actionable for you.

Join us on this journey to mastering your future, where we turn challenges into opportunities and help you make informed decisions that align with your goals and aspirations. Let's build a secure and prosperous future together!

Have questions? Need help? Contact us

Feel free to reach out during our business hours for assistance with estate planning, tax law, financial services, or other legal matters.

Call Us:

Visit Our Office:

10155 W. Twain Ave Ste 100 Las Vegas, NV 89147

Business Hours:

Monday - Friday: 8:00 AM - 5:00 PM

Copyright 2024 – CPA Attorney