Guiding Your Financial Journey

Professional Insights on Estate, Tax, and Wealth Management

Top 10 Bookkeeping Mistakes Small Businesses Make: | CPA Attorney

Top 10 Bookkeeping Mistakes Small Businesses Make

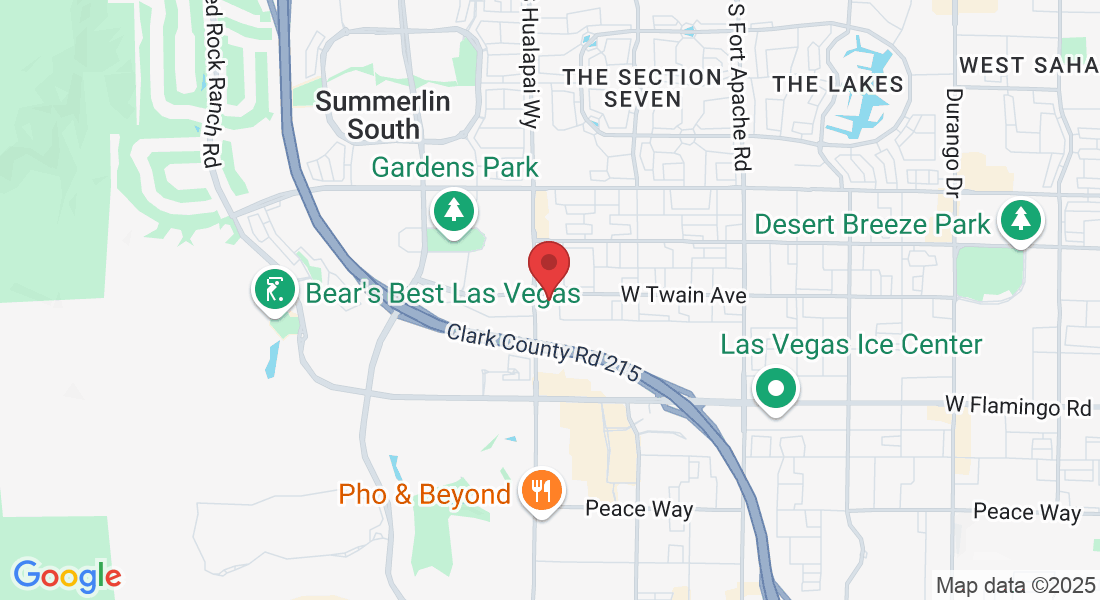

Many things can go wrong with a small business’s books that will inevitably hurt the business. A lack of accurate records may also mean that the business will not pay the correct amount of taxes. Luckily, there are ways to avoid these bookkeeping pitfalls. The following is a list of the top 10 bookkeeping mistakes small businesses make, along with tips to avoid making these errors. For help with your bookkeeping and accounting needs, or if you have legal questions regarding your current accounting challenges, consider calling CPA Attorney at (702) 420-0217 to schedule a consultation.

Inaccurate Record-keeping

The first thing to consider is the accuracy of the business’s records. Maintaining inaccurate records will inevitably hurt any business and may lead to tax penalties or financial issues at a later time. It is important to maintain accurate records for both internal and external purposes, so consider creating a system that will make it easier to keep up with the business’s books. There are many different recordkeeping systems that you can find online that may help ease this process.

Unreconciled Bank Accounts

Having unreconciled bank accounts is the most common bookkeeping mistake small business owners make. When the business’s transactions do not match the balances in the accounting

software or spreadsheet, other mistakes can also occur. Business owners should take the time to reconcile their bank accounts on a regular basis—at least once a week.

At the end of each week, make sure that the totals match. If there is a discrepancy, take some time to determine what the error is and make the appropriate corrections, whether the error is in the books or the bank.

Sales Tax Oversights In Nevada, sales tax is charged on tangible personal property, according to the State of Nevada Department of Taxation. Sales tax can be one of the most confusing parts of bookkeeping, but it is something that business owners must track in order to remain compliant. Small businesses are required to pay sales tax on all products and services. If a business does not calculate these taxes accurately, the business owner may owe more than expected or be required to pay a fine to the government.

Small business owners can avoid this mistake by remaining diligent about collecting and reporting sales tax. A system to keep track of when the business makes a sale, whether in person or online, will generate a report of the monthly totals. Be sure to include any taxable discounts or other adjustments for customers, such as coupons or gift cards.

Misclassified Staff

Some small businesses have employees, while others have independent contractors. Still more have a combination of employees and independent contractors. Some independent contractors refer to themselves as consultants, freelancers, or other similar terms. A person who provides a service for the business can easily be misclassified as an employee when he or she is actually an independent contractor or vice versa.

Correct classification of a small business’s staff is important to avoid potential penalties from the Internal Revenue Service (IRS) or other government entities. It is also important to classify staff correctly to avoid lawsuits from any staff who have been misclassified. At CPA Attorney, we can help small business owners with the IRS classification test to determine whether each staff member is an employee or an independent contractor.

Miscommunications with the Bookkeeper

One of the most common bookkeeping mistakes that small businesses make is miscommunicating with the bookkeeper. The bookkeeper may take a different approach in reconciling accounts than the business owner does, which can lead to errors. Business owners must have a clear understanding of how the bookkeeper is recording transactions. A small business owner should also check to see how the bookkeeper addresses any discrepancies in the accounting process.

Spending Too Much Time on Bookkeeping Tasks

One of the most common mistakes that small businesses can make is spending too much time on bookkeeping tasks. Avoiding this habit can be tricky, as it may feel like there are never enough hours in the day for everything a business owner needs to do. The key is to prioritize the task list and spend more time on tasks that generate income for the business. A business owner who does not have a lot of experience with bookkeeping and who spends too much time trying to keep up with the books may consider hiring a professional to handle the bookkeeping tasks.

Assuming Some Receipts Are Too Small To Keep

When the IRS is unlikely to ask for them, receipts under a certain amount may seem to not be worth keeping. However, keeping all business receipts is important, no matter how small, because they may be deductible expenses. A small business owner cannot predict what the total will be when it is time to file taxes, so it is wise to hang on to all receipts. Those receipts also provide a clear paper trail if the small business is ever audited.

Failure To Track Reimbursable Expenses

Overlooking reimbursable expenses on a small business’s books can be easy because they are often so infrequent. When it comes time to file taxes, however, the owner or bookkeeper will need to figure out which expenses are deductible, and which are not. If the business owner does not track reimbursable expenses, then determining what is and is not deductible will be a lot more difficult, and the business may end up paying too much in taxes for the year.

To avoid this mistake, business owners should always keep detailed records of reimbursable items like mileage or travel costs. They should also create an account within their accounting software that tracks these types of activities so they will be easier to review later.

Failure To Keep Backup Documentation

In order to make sure that a company is compliant with all of the necessary accounting regulations, it is important to keep an accurate record of all financial transactions. Therefore, the business owner should keep backup documentation in case of a computer crash or other catastrophic failure on the business premises. One way to back up business documentation is by using a cloud-based system so that the information can be accessed from any device. Another backup option is to invest in a secondary hard drive.

Failure To Monitor Petty Cash Management

Many small businesses do not use formal processes for petty cash, which can lead to major mistakes. For example, if the small business owner does not keep track of how much petty cash goes out and when, or how much petty cash was there to start, then it may be difficult to calculate the appropriate tax rate for that money later. If small businesses want to stay in control of accounting and pay the appropriate taxes, then it is important to keep accurate records of petty cash transactions.

Consider Contacting an Experienced Accountant and Attorney Today

All the bookkeeping mistakes in this list are easy to avoid by learning the basic bookkeeping skills or hiring an experienced bookkeeper. Consider contacting CPA Attorney at (702) 420-0217 to learn more about how to avoid these mistakes and recovering from any that may have already been made.

© Copyright 2025 – CPA Attorney