Won’t My Spouse and Kids Inherit Everything When I Die?

State intestate laws often presume that families consist of a married couple with biological children. However, many families today are more complex, with blended families, stepchildren, or remarriages. Without an estate plan, these family dynamics may not be properly recognized by the law.

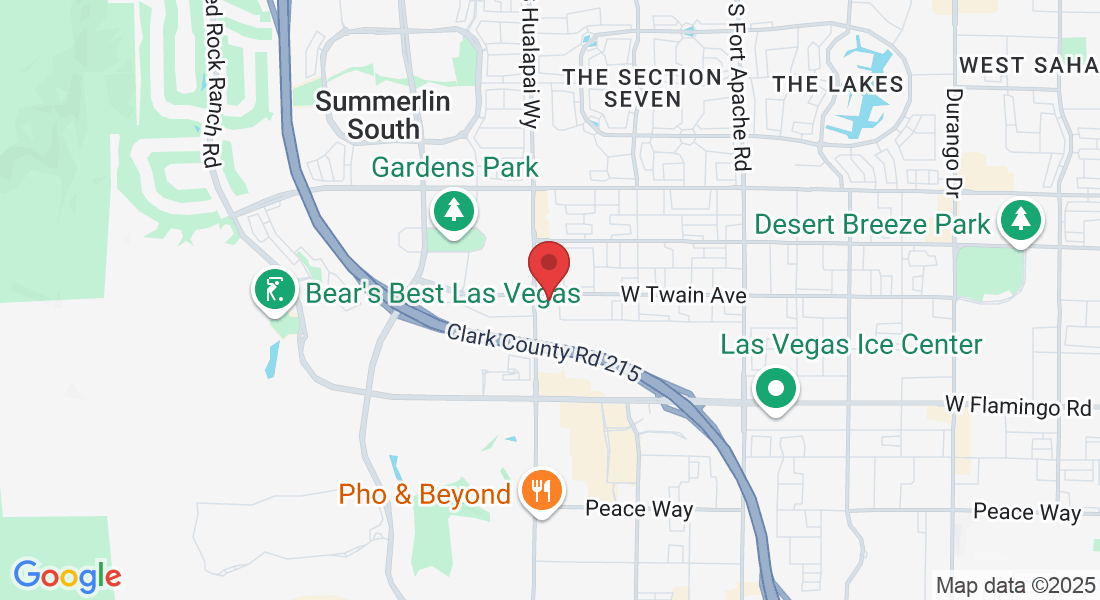

According to an analysis of family types in America, there are over 50 common family structures across households today . Additionally, approximately 40% of all marriages in the U.S. involve remarriages for at least one spouse . In cases involving stepchildren or blended families, intestate laws may lead to unfair or unintended outcomes. For example, a scenario where a couple—Carey and Blake—each have a child from a previous relationship and one child together could lead to unintentional outcomes. Carey’s assets might be divided between Blake and her biological children, but Blake's child from the prior relationship may receive nothing. In Nevada, as in other states, stepchildren or non-biological family members may not automatically inherit without a formal will or trust. If you are concerned about protecting your blended family’s future, consider setting up a revocable living trust.

Key Point: Without proper planning, your estate could be divided in ways you don’t intend. Consider speaking with a Las Vegas estate planning attorney to ensure your assets are distributed according to your wishes.

Avoiding Probate and Maintaining Privacy

Another issue with relying on state law is that transfers to your loved ones don’t happen automatically. The probate process, which your family must go through to distribute your assets, can be long, expensive, and public. In Nevada, probate fees and court costs can take a significant portion of your estate’s value.

By creating and funding a revocable living trust, you can avoid probate and maintain your family’s privacy. This estate planning tool allows your assets to transfer seamlessly to your beneficiaries without the need for court intervention. To learn more about how a revocable trust can help you avoid probate, consult with a Las Vegas trust attorney.

Protecting Minor Children in Case of Tragedy

One critical aspect of estate planning is designating a legal guardian for your minor children. Without a will, the court decides who will take care of your children. Even if it’s clear to everyone that your godparent or grandparent is the best choice, the court may appoint someone else based on Nevada’s guardianship laws.

By drafting a will, you can make your preferences known to the court and ensure your children are cared for by someone you trust. A consultation with an experienced Las Vegas estate attorney can guide you through this process.

Estate Planning During Separation or Divorce

If you and your spouse are separated but not yet divorced, Nevada law may still treat you as legally married. This could result in your estranged spouse inheriting part of your estate, even if your divorce is pending. Nevada’s intestacy laws generally provide a surviving spouse with a portion of your estate, and some court orders may prevent you from disinheriting your spouse during the divorce process.

To protect your assets during this vulnerable time, consult with a Las Vegas divorce attorney and an estate planning attorney. A prenuptial or postnuptial agreement can provide additional safeguards for your estate.

Take Control of Your Estate Planning

Don't leave the fate of your estate in the hands of state laws. Protect your family, your property, and your legacy by creating a comprehensive estate plan. Contact our team of experienced Las Vegas estate planning attorneys at CPA Attorney today.

Sources:

David H. Lenok, "The 50 Most Common Family Types in America," WealthManagement.com (July 20, 2016), WealthManagement.com Article.

Jannik Lindner, "Remarriage Trends: Statistics Show Complex Dynamics for Couples Blending Families," Gitnux (July 17, 2024), Gitnux Article.

© Copyright 2025 – CPA Attorney