DIY Deeds for Probate Avoidance: Risks and Legal Considerations

Caution: Using a DIY Deed to Avoid Probate Can Lead to Unintended Consequences

One common way to avoid the probate requirement for real estate after the owner dies is to add children or other individuals to the property title as joint owners with rights of survivorship. When joint owners have survivorship rights and one joint owner passes away, the remaining owners automatically receive the entire interest of the deceased owner.

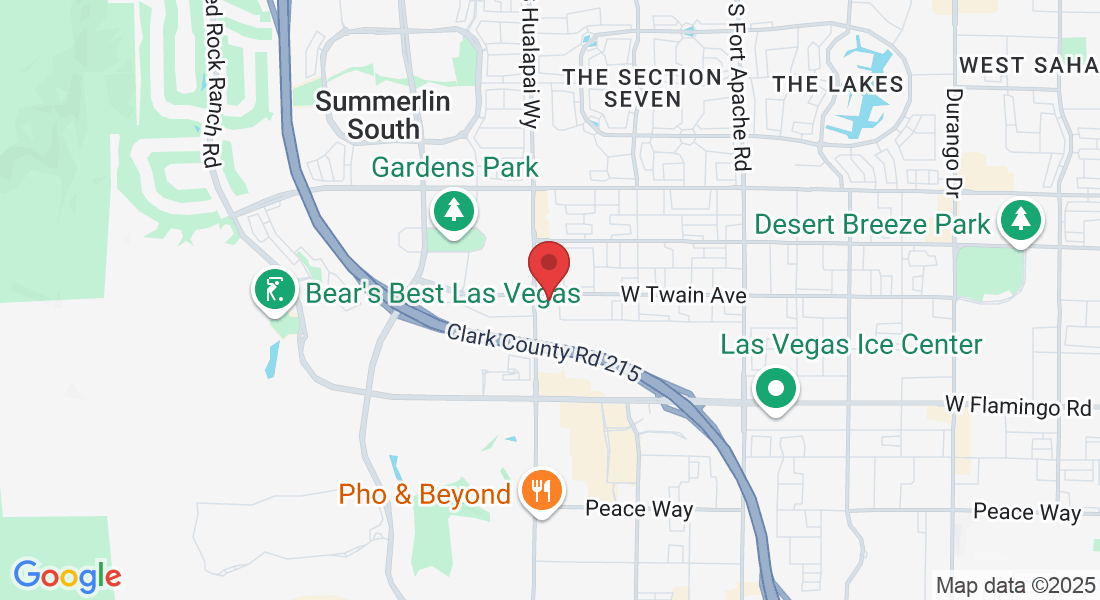

Don't risk costly mistakes with DIY deeds. Let the experts at CPA Attorney LLC ensure your property transfers smoothly and legally. Call us at 702-852-2577, email [email protected], or schedule online via Calendly for professional guidance in avoiding probate and protecting your legacy.

For example, if there are three joint owners with rights of survivorship, when one passes away, the two remaining owners each own 50 percent of the real estate by operation of law. No court involvement or probate is required to make this transfer. When the second owner passes away, the surviving owner owns 100 percent of the real estate. Again, no probate is required to make this transfer.

To create joint ownership with survivorship rights, the current owner prepares a new deed that transfers the property from themselves (as the original owner) to themselves and the children or other individuals they would like to share in ownership. The deed should also include language to indicate that the recipients are joint owners with rights of survivorship. The exact language included in the deed will be governed by state law. The signed deed is then recorded in applicable public land records.

Many believe they do not need an attorney to help them prepare and record a new deed. Instead, they think a deed template can simply be downloaded online or obtained from a book, filled out, signed, and then easily recorded. However, deeds are legal documents that must comply with state law to be valid. In addition, in many states, property will not pass to the other owners listed in a deed free of probate unless certain specific legal terms are included in the deed.

What Happens if There Is a Mistake with My Deed?

If there are problems with a defective deed or a deed is invalid, and it is discovered before the owner dies, then the problems may be addressed by preparing and recording a corrective deed in the applicable public land records, depending on your state law. This should be done only with the assistance of an attorney to ensure that the correction is actually a correction and causes no additional issues with the deed or property title.

Unfortunately, problems with a defective or invalid deed are often not discovered until after the owner’s death. If this is the case, the problems cannot be fixed with a corrective deed since the deceased owner is unable to sign it. Instead, the property will most likely need to be probated to correct the problems with the title. Aside from the probate process taking time and costing money for legal fees and court expenses, the property cannot be sold until the problems with the title have been sorted out in probate court. Worse yet, the property could end up being inherited by someone the owner did not want receiving it, either because they intended to disinherit the individual or because they wanted someone else to receive the property.

What Should You Do?

If you want to add your children or other beneficiaries to your deed to avoid probate and you think you can save a few bucks by using a form you find online or in a book, think again. Deeds are legal documents with very specific requirements and are governed by different laws in each state (in other words, a deed valid in New York may not necessarily be valid in Florida).

Don't leave your property's future to chance. Consult with CPA Attorney LLC to ensure your real estate passes smoothly to your intended beneficiaries without probate. Our experienced attorneys are well-versed in state-specific probate and real estate laws, and can guide you through the complexities of deed transfers, gifting considerations, tax implications, and potential misuse risks. We'll help you explore all available options to avoid probate and protect your legacy, tailoring a plan that best serves your interests and honors your wishes for your loved ones. Ready to craft a solid plan for your property?

Take action now

Call us at 702-852-2577

Email [email protected]

Schedule online via Calendly

Let CPA Attorney LLC be your trusted partner in securing your property's future and your family's peace of mind..

© Copyright 2025 – CPA Attorney