Guiding Your Financial Journey

Professional Insights on Estate, Tax, and Wealth Management

Choosing The Right Business Structure

How To Choose The Right Business Structure For Your New Company

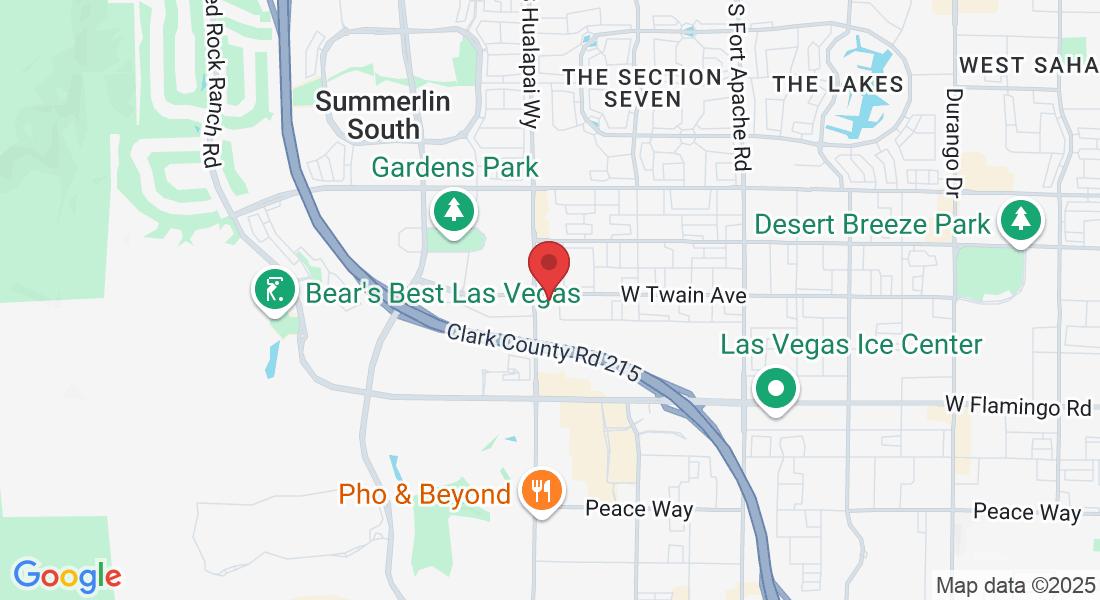

Establishing a new business can be as stressful as it is exciting. From designing a website and developing product prototypes to receiving your first few customers, there an incredible amount of work that goes into launching a business. One of the most important decisions that new business owners must make is the appropriate business structure for their goals and objectives. Not only will this decision impact how much the new business owner will have to pay in taxes, but it will also dictate personal liability and the manner in which the business makes money. For more information regarding how to choose the right business structure for your new company, consider contacting CPA Attorney at (702) 852-2577.

Understanding the Types of Business Structures

When a company is established, a legal business structure must be chosen to determine liability, taxation, and record-keeping. The type of legal structure that a business owner selects for the company directly influences the day-to-day operations of the business. It also dictates the way that the business will be viewed from a legal perspective and the rights that the business will have under the law. The four main types of business structures that an entrepreneur can select for his or her new company are:

● Sole Proprietorship

● Partnership

● Corporation

● Limited Liability Company (LLC)

Choosing the right business structure for a new company starts with evaluating goals, considering state and federal legislation, and determining the level of liability that the business owner is comfortable with. Every business owner’s situation is unique, which makes choosing a business structure a very personal decision. While it is possible to alter your business structure later, the process for the change can be complex, which makes it even more important to assess your options carefully in the beginning.

What Is a Sole Proprietorship?

The fastest, simplest, and most cost-effective way to form a business entity is through sole proprietorship. This is an ideal option for self-employed individuals and small business owners who wish to have complete managerial control over their company.

Sole proprietorships are unincorporated business entities with no distinction between the business and the business owner. This means that the owner is personally liable for all of the company’s financial obligations. With over 23 million sole proprietorships in the United States, this is by far the most common business structure.

What Is a Partnership?

Another simple business structure is the partnership, which involves two or more individuals who share the ownership rights to a company. Like sole proprietorships, partnerships are unincorporated entities. This business structure is ideal for family members, friends, or business partners who wish to start a company together.

In a partnership, the partners share the liability, meaning that each individual carries the risks associated with the other partners’ actions. For this reason, it is highly important to carefully draft partnership agreements. An experienced financial attorney at CPA Attorney can help ensure that the partnership agreement reflects the interests of both parties while reducing the associated risks.

What Is a Corporation?

Legally, corporations are regarded as completely separate entities from their owners. In this way, corporations have their own legal rights. Corporations can sue and be sued, own and sell property, be taxed, and sell ownership rights in the form of stocks. There are a few different types of corporations, but the most common are C corporations and S corporations. A CPA Attorney can further explain the different types of corporations that are available to business owners and discuss the liabilities associated with each structure.

What Is a Limited Liability Company (LLC)?

An LLC is a hybrid business structure that permits owners, shareholders, and partners to limit their personal liabilities while simultaneously enjoying the tax benefits and flexibility offered by partnerships. There is no limit to the number of shareholders in an LLC, and all profits and losses pass through the owners as income on their annual income tax returns. Both small and large companies can utilize the LLC business structure.

What Are the Advantages of Each Business Structure?

Each structure has its own advantages and disadvantages, and those differ according to the specific needs of the business owner and the business itself. Here, we have listed in one place the primary advantages of each of the four main business structures:

● Sole proprietorship

○ Inexpensive to create

○ Easy setup or dissolution

○ Low risk

○ Full control of the business

● Partnership

○ Easy to form

○ Shared responsibilities

○ Greater potential to borrow capital from a bank or other lender

● Corporation

○ Reduced liability

○ Business operations that are unaffected by death or the transfer of shares

○ Easier to raise investment capital

● Limited Liability Company (LLC)

○ Easy to form

○ Flexibility

○ No personally liability to owners

Factors to Consider When Choosing a Business Structure

Deciding which business structure to use is not always straightforward. It is important for a new business owner to consider his or her personal financial needs, the level of risk that he or she is willing to take on, and the growth potential of the company. Consider the following factors to help choose the right business structure for your company:

● Liability—Are you willing to be personally liable for your business?

● Flexibility—Does the business structure provide room to grow and scale the company?

● Taxes—Are you required to account for the profits and losses of your business in your personal tax returns?

● Control—Do you wish to have total control of the company? Or are you willing to consult others, such as an executive board, before making business decisions?

● Capital investment—Do you need to secure capital investments in order to start or continue operating your business?

The answers to these questions and more can help ensure that a new business owner selects the right business structure for his or her company. For more personalized advice, however, consider seeking legal assistance from an experienced CPA and business attorney.

How Can a CPA Attorney Help Me Choose the Right Business Structure?

Seeking assistance from an experienced attorney can help ensure that you choose the right business structure for your company. At CPA Attorney, we leverage our background in law and accounting to provide advice to business owners. Every decision matters when starting a new business, and it is important to consider all legal and financial matters carefully. An experienced attorney can help you determine what your goals and interests are and decide on the proper business entity for you. Consider contacting us at 702-852-2577 to start a conversation today.

© Copyright 2025 – CPA Attorney