Award-Winning CPA & Tax Attorney in Las Vegas

Tax Attorney & CPA in Las Vegas | Estate Planning & Wealth Protection

As a licensed CPA and tax attorney in Las Vegas, we help clients protect their wealth, reduce taxes, and plan for the future with confidence. Whether you need advanced tax strategies, estate planning, or asset protection, you get both the tax expertise of a CPA and the legal power of an attorney—all in one place.

Unlike traditional CPA firms, we're dually qualified with both CPA and legal credentials.

Why Choose Our Las Vegas CPA & Tax Attorney Team

Why Business Owners & High-Earners Choose Our Integrated Tax & Estate Planning Services

Integrated Tax & Legal Strategy

We combine CPA expertise with legal strategy to save you thousands in taxes while protecting your estate and assets. Unlike traditional cpa firms or tax accountants, you get integrated financial planning that's both tax-efficient and legally protected.

Strategic Tax Planning All Year Round

We go beyond seasonal tax preparation. Our proactive tax and wealth planning identifies deductions, optimizes your business structure, and implements strategic tax minimization throughout the year—not just at tax filing time.

Proactive Asset & Wealth Planning

We protect what you've built. From business asset protection to estate trust tax optimization and wealth planning, we design strategies that secure your financial future against liability, taxes, and probate complications.

Integrated Tax & Legal Solutions for Every Situation

Our CPA & Tax Attorneys Help Las Vegas Business Owners & High-Earners Achieve Financial Security

Tax problems keeping you up at night? Uncertain about your business structure? Worried about protecting your wealth? Our Las Vegas CPA & attorneys specialize in solving complex financial and tax challenges through integrated expertise.

Minimize taxes and protect assets through strategic tax planning and business structuring

Achieve wealth security with comprehensive estate planning and estate trust tax optimization

Implement tax-efficient wealth transfer and legacy planning strategies while meeting state requirements

Get expert resolution for IRS issues, back taxes, or tax disputes and minimize liability

Unlike traditional cpa firms, tax accountants, or tax professionals working separately, our dually qualified CPA and attorney approach ensures you get both the tax optimization and legal protection every decision requires.

Featured Services

Choosing a CPA & Tax Attorney gives you a competitive edge in managing your

Tax and Bookkeeping, Advanced Tax Strategies, Asset Protection and Estate Planning, and Wealth Management needs.

Start Your Tax, Estate, and Wealth Strategy Today!

What Our Clients Are Saying

Discover how our personalized legal and financial solutions have transformed lives. Read testimonials from clients who have benefited from our expert estate planning, tax strategies, and financial guidance.

Best tax aTTORNEY IN LAS VEGAS

Comprehensive Tax, Estate, and Financial Solutions by a Trusted CPA & Attorney

CPA Attorney in Las Vegas services clients throughout the country offering tax and estate planning solutions to business owners, individual, and trusts among others. The firm specializes in tax and estate planning techniques for lowering taxes and protecting assets. We Also provide bookkeeping, tax preparation, and entity formation services among others. The firm’s managing attorney is a licensed attorney, Certified Public Accountant (CPA), and Realtor.

Still have questions?

Frequently Asked Questions About Tax & Estate Planning Services

Get answers to common questions about our CPA & attorney services, tax strategies, and how we can help you

FAQ #1: What's the difference between a tax attorney and a CPA?

CPAs handle tax compliance and strategy—deductions, credits, business structure. Tax attorneys do the same thing, but they also protect your assets and represent you in legal disputes.

The real difference: a tax attorney gives you both tax strategy AND legal protection. A CPA alone can't represent you before the IRS or set up legal protections through trusts and entity structures.

Our combined approach means you get tax planning that's also legally bulletproof—something you can't get from either one working solo.

FAQ #2: How much can I save with advanced tax planning?

Depends on your situation. Most business owners and high-net-worth clients save $10,000 to $50,000+ annually through strategic tax planning—sometimes much more.

Common wins:

• S-Corp conversion: $10,000-$30,000+ in self-employment tax savings

• Retirement optimization: SEP-IRA, Solo 401(k), defined benefit plans

• Tax-loss harvesting: Strategic investment timing

• Cost segregation: Accelerated depreciation on real estate

• Charitable strategies: Donor-advised funds, charitable trusts

Your actual savings? Only a tax analysis reveals that.

FAQ #3: Do I need a CPA & attorney or just a regular tax preparer?

A basic tax preparer works if you're filing a simple personal return. A CPA attorney makes sense if you:

• Own a business (any structure)

• Make $100,000+ annually

• Have investments or real estate

• Want to minimize taxes

• Need asset protection

• Face IRS issues or back taxes

• Have a complex financial situation

Basic preparers file returns. CPA attorneys structure your entire financial life for tax efficiency AND legal protection. For most business owners, the tax savings pay for our services multiple times over.

FAQ #4: What is asset protection and why do I need it?

Asset protection is a legal strategy to shield your wealth from lawsuits and creditors. One lawsuit can wipe you out if your assets aren't structured properly.

You need it if you own a business, practice medicine, invest in real estate, or have significant wealth. The higher your net worth, the bigger the target.

Common strategies:

• Business entities (LLCs, S-Corps) to separate liability

• Insurance coverage (liability, umbrella policies)

• Trusts (revocable, irrevocable)

• Strategic ownership structures

• Retirement account protection

Critical: Set this up BEFORE you get sued. Once litigation starts, it's too late.

FAQ #5: What is included in estate planning?

Estate planning includes a will, trusts, and documents that control what happens to your money and who makes decisions if you can't.

What you get:

• Will: How assets transfer and who's in charge

• Trusts: Avoid probate, reduce taxes, protect assets

• Beneficiary designations: Retirement accounts, life insurance, investments

• Power of attorney: Financial and healthcare decision-making

• Guardianship: Care for minor children

For high-net-worth situations, add:

• Charitable trusts

• Family limited partnerships

• GRATs and QPRTs

• Tax-efficient wealth transfer

Without planning, your assets get stuck in probate for months. Proper planning keeps control in your hands and keeps taxes out of your family's way.

FAQ #6: How do you handle IRS issues and back taxes?

Facing the IRS sucks. But you don't handle it alone.

Our process is straightforward:

1. Analyze your situation and all IRS communications

2. Explore options: payment plans, offers in compromise, innocent spouse relief, currently not collectible status

3. Represent you before the IRS during negotiations

4. Reduce penalties and interest where possible

5. Ensure compliance going forward with proper payments and record-keeping

As both a CPA and attorney, we negotiate from both angles—tax and legal. That's stronger than hiring separately. We've resolved unfiled returns, back taxes, audits, collections notices, wage garnishments, bank levies, and tax disputes.

FAQ #7: What business structure should I choose (LLC, S-Corp, C-Corp)?

No universal answer. It depends on income, ownership, liability risk, and growth plans.

Quick breakdown:

• Sole Proprietor: Cheap to set up, zero liability protection. Don't do this if you want to protect personal assets.

• Partnership: Same problem—no liability shield.

• LLC: Liability protection, pass-through taxes, flexible. Good for most small businesses.

• S-Corp: Liability protection PLUS huge tax savings. If you make $40,000-$60,000+, you could save $10,000+ annually in self-employment taxes.

• C-Corp: Full liability protection but double taxation. Usually for big companies.

Best move for most: LLC taxed as an S-Corp. Maximum protection, maximum tax savings.

We analyze your situation and recommend what actually works for you. The tax savings usually pay for the consultation multiple times over.

FAQ #8: How often should I meet with my CPA & attorney?

Depends on complexity. Most business owners and high earners benefit from quarterly or semi-annual meetings. At minimum: annual comprehensive tax planning before year-end.

Regular meetings let us:

• Monitor your tax situation and adjust as things change

• Spot planning opportunities before they vanish

• Stay ahead of tax law changes

• Answer questions without waiting

• Keep you proactive, not reactive

• Lock in time-sensitive strategies before December 31

Think of us as your ongoing financial strategist, not just someone you call in April.

FAQ #9: What should I bring to my initial consultation?

Bring relevant documents. Here's the checklist:

• Tax returns: Last 2-3 years (personal and business)

• Business documents: Formation docs, operating agreements, P&L statements

• Income documents: W-2s, 1099s, rental income

• Investments: Brokerage statements, crypto, stock options

• IRS stuff: Any notices, audit letters, collection notices

• Estate documents: Will, trusts, beneficiary designations

• Financial statements: Balance sheet, cash flow

• Assets: Real estate deeds, retirement accounts, valuable property

Don't panic if you're missing something—we'll tell you what we need. More documents = better analysis.

Most important: Come with clear goals and questions. What do you want to achieve? What keeps you up at night? That's what we focus on.

FAQ #10: Do you serve clients outside of my state?

Yes. We serve clients nationwide entirely through phone, video, and secure document sharing.

Your state doesn't matter—tax laws do. We handle federal tax law and multi-state issues. For state-specific compliance, we partner with local professionals in your area while we manage the federal strategy.

What we handle for out-of-state clients:

• Federal income tax planning and preparation

• Estate planning and trusts

• Business structure optimization

• Asset protection

• IRS representation and tax resolution

• Multi-state tax coordination

• Ongoing tax strategy

Nevada, California, New York, or anywhere in between—we can help.

Legacy and Tax Solutions

Call us at 702-852-2577 to get started.

Get In Touch!

Our expert CPA and tax attorney team in Las Vegas is ready to meet your tax, estate, and financial needs.

Reach out to us for comprehensive support and guidance.

Call Us Today:

702-852-2577

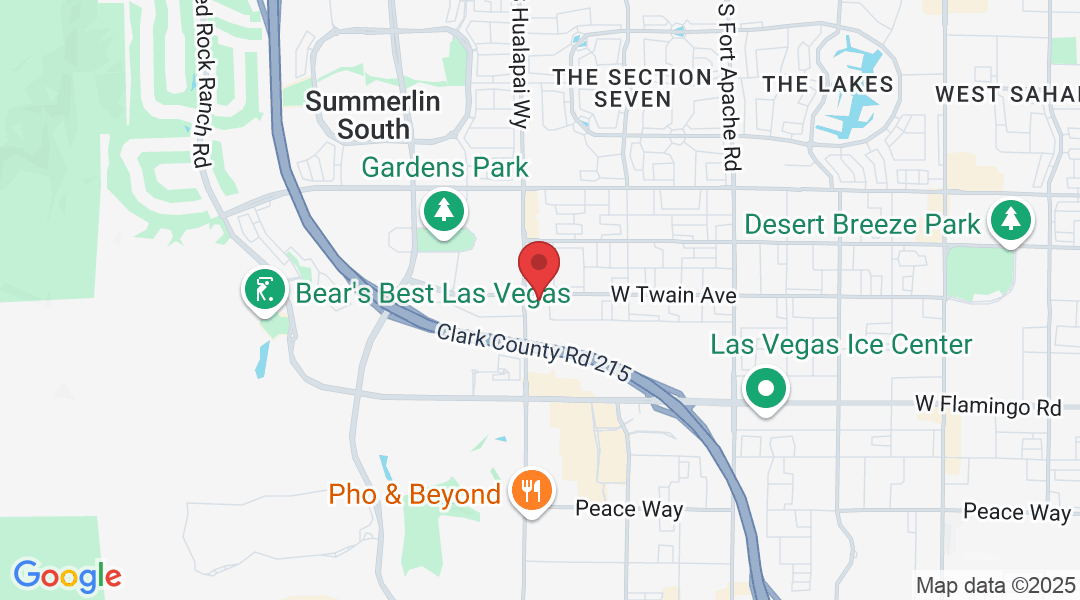

Visit Our Office:

10155 W. Twain Ave Ste 100

Las Vegas, NV 89147

Business Hours:

Monday - Friday: 8:00 AM - 5:00 PM

CPA Attorney, LLC Serving Las Vegas, Nevada

As a dual-licensed CPA and Attorney, we provide comprehensive estate planning, asset protection, tax strategies, and trust planning for Las Vegas families and businesses. Our unique expertise combines legal protection with tax optimization—giving you strategies others simply can't offer.

✓ In-Person & Virtual Consultations Available

© Copyright 2025 – CPA Attorney